Last night, Federal Reserve Chairman Powell delivered a key speech at the New York Economic Club, which was a critical statement before the Fed's rate hike in November, essentially indicating whether there would be a rate hike in November. Powell stated that, on the one hand, considering many uncertainties and risk factors, the Fed would act cautiously; on the other hand, if policymakers see further signs of strong economic growth, there could be another rate hike. Last night, the yield on the U.S. ten-year bond briefly touched the key level of 5%.

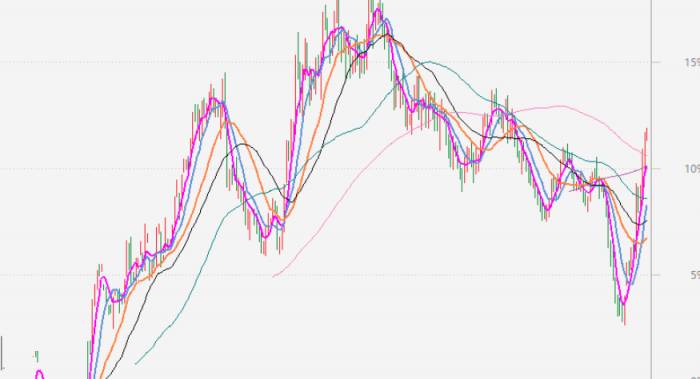

Due to the U.S. bond yield surging to a historical high of 5%, it has played a role in raising interest rates to a certain extent. Moreover, the soaring U.S. bond yield has had a greater impact on the financial market. The short-selling transactions are extremely crowded, reinforcing the expectation that the U.S. bond yield will continue to rise, and the demand for U.S. Treasury bonds is weak. Therefore, the Fed has to be more cautious, but for the sake of expectation management, unless there are clear signs of a recession in the U.S. economy, the Fed will not give a clear signal to stop raising interest rates. Currently, short-term Treasury yields are falling, while long-term Treasury yields are rising, which is more due to trading factors. After Powell's speech, the market fully priced in no rate hike in November and lowered the expectation of a rate hike in December.

Advertisement

Due to the U.S. bond yield approaching the key level of 5% and Tesla's performance not meeting expectations, the U.S. stock market opened low last night, with the Nasdaq falling 0.96%, and Tesla plummeting 9.30%.

There is a strange phenomenon in the current market, that is, the international gold price and the U.S. bond yield have diverged. Historically, the gold price and the U.S. bond yield have an inverse relationship. When the U.S. bond yield rises, the attractiveness of gold as a non-interest-bearing asset will decrease, and the gold price will fall.

If we must explain this divergence, the main reason for the surge in gold prices is the escalation of the Israeli-Palestinian conflict, which has triggered a safe-haven sentiment that has pushed up gold prices. In addition, the Fed's statement on temporarily halting interest rate hikes has further increased the value of gold. However, U.S. bonds, as a safe-haven asset, should also be favored by funds. It can only be said that in the short term, on the trading level, bearish factors far outweigh the safe-haven sentiment.

Due to the surge in U.S. bond yields and the escalation of the situation in the Middle East, the U.S. stock market last night and global stock markets in the Asia-Pacific, Europe, Africa, and the Middle East basically closed lower today.

As of the close of the A-share market, the Shanghai Composite Index fell by 0.74%, the ChiNext Index fell by 0.88%, the Hang Seng Index in Hong Kong fell by 0.55%, and the Hang Seng Technology Index fell by 1%. The turnover in the two markets shrank significantly to 0.73 trillion, and the net outflow of Northbound funds was 1.646 billion.

Looking at the industry, the real estate, power equipment, comprehensive, non-ferrous metals, and comprehensive finance industries rose, while the communications, computers, electronics, media, and defense industries led the decline.

As we have said before, the problem with A-shares lies in liquidity; it is now a market that is continuously bleeding. We have long made a judgment that when a redemption wave occurs, even if Northbound funds do not sell A-shares, they will fall because the fragile domestic capital structure has been disrupted by foreign capital sales. All kinds of funds can only be forced to cut positions, leading to an accelerated sell-off in the stock market, resulting in financing and pledge defaults and forced liquidation, until liquidity reaches a new equilibrium state to stabilize.

In fact, A-shares could have avoided this situation. China's economy stabilized and warmed up in August, and the subsequent sell-off was entirely due to liquidity issues, without a fundamental basis. Here, it is mainly due to the continuous sales of foreign capital, leading to an imbalance in liquidity. Although the national team entered the market last week, the increase in banks was like scratching an itch through a boot, which did not save the point.In summary, if there is an inflow of incremental funds to improve market liquidity in the future, a rebound can be anticipated, but a reversal may still have to wait for the inflection point of U.S. Treasury yields.

Risk Warning:

The stock market involves risks, and investment should be approached with caution. This article does not constitute investment advice, and readers should think independently.

2024-06-08

2024-06-08